Search all docs

Provider Workflows

Chart Notes

Auto-apply KX Modifier

Getting Started with Chart Notes

AI Appt. Summaries

Chart Note Clinical Types

Download Chart Notes as PDFs

Goals on the chart note

How to add Measurements

Import Previous Medical History

Navigating Flowsheets

Navigating Inbox Workflows

Navigating the Chart Note

Set up Custom Chart Note Templates

Setting up Co-signers on Your Note

Sign a Chart Note

Text Snippets For Your Note

Chart Note Features Not Supported

Chart Notes

Claim Details

Claim Details

Front Office Workflows

Appointments

The Insights Appointments Page

Adding Prior Auth and Alerting

Alternate Methods for Scheduling

How to Add a Walk-In Patient

How to Run an Eligibility Check

How to Schedule an Appointment

How to Take Payments

Sending out reminders and forms

Understanding Appointment Details

Updating Appointment Statuses

Appt. Features not supported

Appointments

Daily Operations

Daily Operations

Patient Communications

General Patient Flows Features

Text Blast Page

Insurance Intake Page

Functional Outcome Measurements

Getting Started with Patient Portal

Complete Intake Forms

Navigating Patient Workflows

Manage Patient Appointments

Manage Payments through Patient Portal

Patient Intake Automation

Update Insurance Info

View Home Exercise Programs

Patient Communications

Patient Responsibility

Charge Saved Credit Cards

Manage Credit Cards

Setting up a Payment Plan

How to Cancel PR

How to Send a Patient Payment Link

How to Push to PR

How to Record Payments

How to Refund a Payment

How to Request via Text or Email

How to Set Up Miscellaneous Line Item Charges

How to Take Payment for Families

How to Undo a Write Off

How to Write Off PR

Patient Responsibility Page

PR Overpayment Refunds and Estimated vs. Remittance PR

PR Settings

PR Timeline

Patient Responsibility

Billing Workflows

Front Office Payments

Front Office Payments

Reports

A/R Reports

Building and Running Reports

Claim Adjustments Report

Collections Report

Custom Collections Report

Detailed Charges Report

Export Claim Details

Generate a Transaction Report

Patient Balances Report

Patient Charges Report

Patient Claims One-pagers

Patient Collections Report

Patient Eligibility Report

Posting Log Report

Site Transaction Report

Site Transaction Report Summary

Submitted Claims Report

Upcoming Patient Statements Report

Reports

Owners & Administration

Last updated:

Aug 20, 2025

Bank Deposit Verification

Utilities

Front Office Workflows

At a Glance

In the world of medical billing, perhaps the two most important questions you can answer are:

How much have payers told us we’ve been reimbursed?

How much of that has actually arrived in our bank account?

Getting a clear answer to #1 can be challenging enough, but some practices are forced to spend tremendous amounts of time manually matching up bank deposits with EOBs in order to make sense of what they’ve been paid and find out what payments are missing.

It’s important work, but it’s also a slog.

That’s why Athelas has a Remittances page, with built-in deposit verification.

In this tab you’ll be able to view a list of every remittance a payer has sent you. Once you plug in your bank account via our secure Plaid integration we’ll attempt to automatically match those remittances up with deposits, reducing the burden of deposit verification by as much as 80%.

Read on, and we’ll dig into the details.

Best Practices

1. While Athelas will be able to automatically match the majority of your remits/deposits, some portion will still need to be manually matched. For this reason it’s worth reviewing your unmatched remittances/deposits at least every 2 weeks to keep the volume of unmatched pairs manageable.

2. Often remittances will arrive a few days before payments hit the bank, so for any remittances younger than 5 days old, don’t be too worried if there’s no corresponding deposit in your bank account just yet.

3. When you deposit multiple checks at once, your bank will usually sum them all up into a single deposit which makes it hard to match them against individual remittances. When you’re looking for payments that correspond to orphaned remittances, this is often a good place to start.

We can reconcile paper check bulk deposits and virtual card transactions

🌐 Core Feature Walkthrough

View All Remittances

Even before you connect your bank account, you’ll be able to view a list of all your recent remittances in chronological order (or a different order if you care to re-sort them).

There can be a lot of data in this view, so we’ve provided tools to help you zoom in on precisely what you’re trying to examine:

Download CSV — for some folks, there’s no place like Excel. If you happen to be a spreadsheet jockey, you’ve got the option to download all the data in this tab. That way you can work in your data manipulation tool of choice.

Filter Remittances — we’ve also provided a wide variety of filters to help you narrow down to just the subset of remittances you’re looking for. This is particularly helpful when investigating missing deposits.

Explore Remittance Details — once you’ve found a remittance you want to examine, clicking on it will take you into a detail view for the remittance. Here you can see each Athelas claim that was a component of the remittance.

Quicklink to Athelas Claim — and to close the loop, clicking any of the specific claims listed in the ERA will open up the Athelas Claim Detail view so you can see remittance info in the context of the rest of the claim details.

Connect Your Bank Account

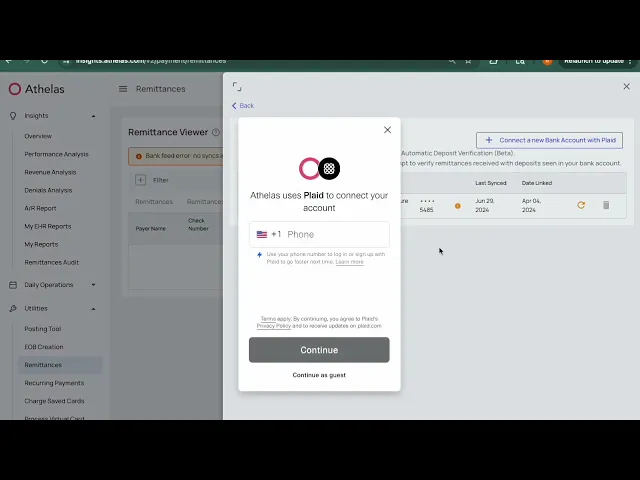

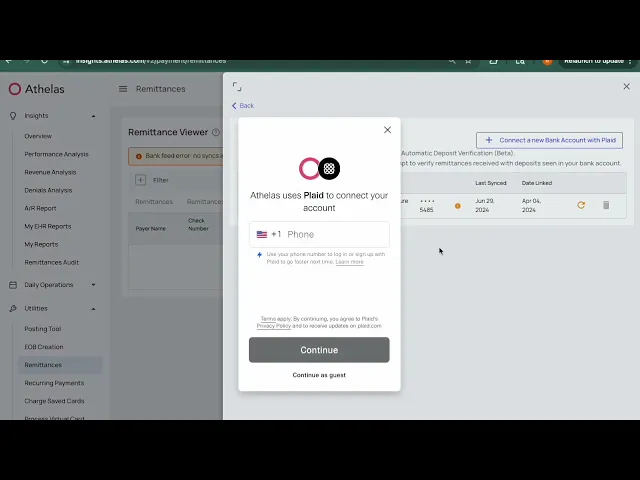

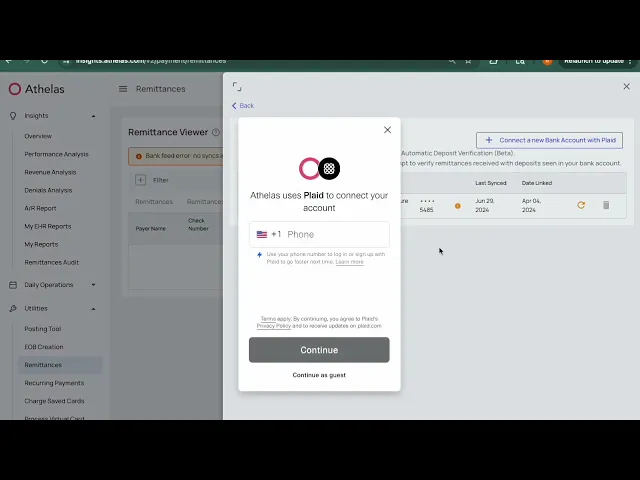

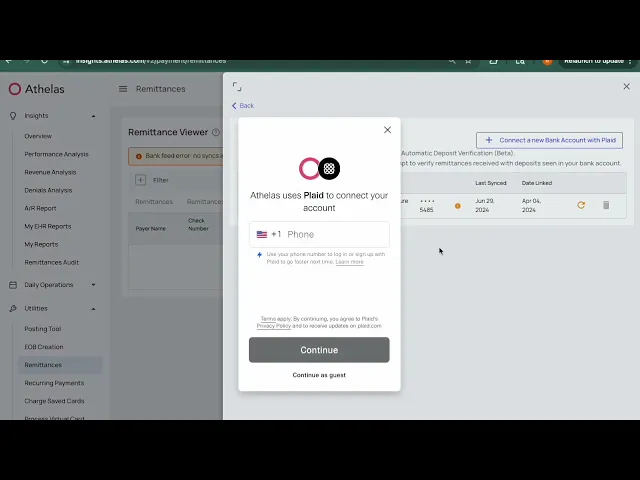

Once you’re ready to start automatically matching remittances and deposits we’ll need to connect to your bank account via the Athelas/Plaid integration. Here’s how to do it:

From the main Remittances tab, click the Connect Bank Accounts button. This will take you to the linked accounts screen.

From the linked accounts screen you can view any currently associated bank accounts, then click ‘Connect a new Bank Account’ to add a new one.

This will launch the Plaid integration screen which will guide you through the process of authenticating with your bank. Once you’re done, read-only access will be delivered to Athelas for analysis.

Once you’ve completed the connection it may take as much as an hour for data to be fully imported and matching to occur. Once an hour has passed, you can move on to analyzing your matches and mismatches.

Note: If you have more than one bank account you’d like to match against remittances, just repeat the process from the top. You can link as many bank accounts as you like.

Refresh or Delete a Bank Account

To refresh or remove an account, simply click ‘Manage Bank Accounts’ on the Remittances page, then click either the Refresh or Delete icon for that account.

Now that your bank account is hooked up and Athelas has had time to run our algorithmic matching protocol, the fun really begins. You now have 5 different ways to segment your data, depending on your objective:

Analyze Matches / Missing Deposits

Now that your bank account is hooked up and Athelas has had time to run our algorithmic matching protocol, the fun really begins. You now have 5 different ways to segment your data, depending on your objective:

View All — in this view you’ll see a combination of both remittances and deposits. Any that have been matched will appear combined into a single line item, but you’ll also see rows for unmatched remittances and unmatched deposits.

Missing ERAs — here you’ll see any deposit for which Athelas couldn’t find a corresponding remittance to match it to.

Missing Payment — on the flip side, this view shows remittances with no payments that could be directly matched to them

Inconsistencies — here Athelas was able to match a remittance to a deposit, but there’s some discrepancy between the two.

Generally this a difference in payment amount (often only a few cents), but each row will specify that the inconsistency in the match is.

Matched Deposits — as you might expect, this view holds all our unproblematic matches where a remittance clearly belongs with a given deposit and the numbers all line up nicely.

In Conclusion

With these tools in hand, the process of tracking down missing payments and missing remittances becomes a lot simpler. As Athelas continues to refine our matching algorithm there will be more and more matches generated automatically.

98%+ ACH deposits matched to a check

💬 FAQs

What should I do if my bank doesn’t integrate with Plaid?

Reach out to support@getathelas.com and we’ll see if we can manage an alternate method of importing your deposit list. Occasionally this isn’t possible, but often we’re able to find a suitable workaround.

Features In Development

Lockbox integrations

Enhanced deposit matching reporting in Insights

Features Not Supported

Local regional banks not on Plaid

Integrations With:

Plaid

Stripe

Table of Contents

Search all docs

Provider Workflows

Chart Notes

Auto-apply KX Modifier

Getting Started with Chart Notes

AI Appt. Summaries

Chart Note Clinical Types

Download Chart Notes as PDFs

Goals on the chart note

How to add Measurements

Import Previous Medical History

Navigating Flowsheets

Navigating Inbox Workflows

Navigating the Chart Note

Set up Custom Chart Note Templates

Setting up Co-signers on Your Note

Sign a Chart Note

Text Snippets For Your Note

Chart Note Features Not Supported

Chart Notes

Claim Details

Claim Details

Front Office Workflows

Appointments

The Insights Appointments Page

Adding Prior Auth and Alerting

Alternate Methods for Scheduling

How to Add a Walk-In Patient

How to Run an Eligibility Check

How to Schedule an Appointment

How to Take Payments

Sending out reminders and forms

Understanding Appointment Details

Updating Appointment Statuses

Appt. Features not supported

Appointments

Daily Operations

Daily Operations

Patient Communications

General Patient Flows Features

Text Blast Page

Insurance Intake Page

Functional Outcome Measurements

Getting Started with Patient Portal

Complete Intake Forms

Navigating Patient Workflows

Manage Patient Appointments

Manage Payments through Patient Portal

Patient Intake Automation

Update Insurance Info

View Home Exercise Programs

Patient Communications

Patient Responsibility

Charge Saved Credit Cards

Manage Credit Cards

Setting up a Payment Plan

How to Cancel PR

How to Send a Patient Payment Link

How to Push to PR

How to Record Payments

How to Refund a Payment

How to Request via Text or Email

How to Set Up Miscellaneous Line Item Charges

How to Take Payment for Families

How to Undo a Write Off

How to Write Off PR

Patient Responsibility Page

PR Overpayment Refunds and Estimated vs. Remittance PR

PR Settings

PR Timeline

Patient Responsibility

Billing Workflows

Front Office Payments

Front Office Payments

Reports

A/R Reports

Building and Running Reports

Claim Adjustments Report

Collections Report

Custom Collections Report

Detailed Charges Report

Export Claim Details

Generate a Transaction Report

Patient Balances Report

Patient Charges Report

Patient Claims One-pagers

Patient Collections Report

Patient Eligibility Report

Posting Log Report

Site Transaction Report

Site Transaction Report Summary

Submitted Claims Report

Upcoming Patient Statements Report

Reports

Owners & Administration

Search all docs

Provider Workflows

Chart Notes

Auto-apply KX Modifier

Getting Started with Chart Notes

AI Appt. Summaries

Chart Note Clinical Types

Download Chart Notes as PDFs

Goals on the chart note

How to add Measurements

Import Previous Medical History

Navigating Flowsheets

Navigating Inbox Workflows

Navigating the Chart Note

Set up Custom Chart Note Templates

Setting up Co-signers on Your Note

Sign a Chart Note

Text Snippets For Your Note

Chart Note Features Not Supported

Chart Notes

Claim Details

Claim Details

Front Office Workflows

Appointments

The Insights Appointments Page

Adding Prior Auth and Alerting

Alternate Methods for Scheduling

How to Add a Walk-In Patient

How to Run an Eligibility Check

How to Schedule an Appointment

How to Take Payments

Sending out reminders and forms

Understanding Appointment Details

Updating Appointment Statuses

Appt. Features not supported

Appointments

Daily Operations

Daily Operations

Patient Communications

General Patient Flows Features

Text Blast Page

Insurance Intake Page

Functional Outcome Measurements

Getting Started with Patient Portal

Complete Intake Forms

Navigating Patient Workflows

Manage Patient Appointments

Manage Payments through Patient Portal

Patient Intake Automation

Update Insurance Info

View Home Exercise Programs

Patient Communications

Patient Responsibility

Charge Saved Credit Cards

Manage Credit Cards

Setting up a Payment Plan

How to Cancel PR

How to Send a Patient Payment Link

How to Push to PR

How to Record Payments

How to Refund a Payment

How to Request via Text or Email

How to Set Up Miscellaneous Line Item Charges

How to Take Payment for Families

How to Undo a Write Off

How to Write Off PR

Patient Responsibility Page

PR Overpayment Refunds and Estimated vs. Remittance PR

PR Settings

PR Timeline

Patient Responsibility

Billing Workflows

Front Office Payments

Front Office Payments

Reports

A/R Reports

Building and Running Reports

Claim Adjustments Report

Collections Report

Custom Collections Report

Detailed Charges Report

Export Claim Details

Generate a Transaction Report

Patient Balances Report

Patient Charges Report

Patient Claims One-pagers

Patient Collections Report

Patient Eligibility Report

Posting Log Report

Site Transaction Report

Site Transaction Report Summary

Submitted Claims Report

Upcoming Patient Statements Report

Reports

Owners & Administration

Last updated:

Aug 20, 2025

Bank Deposit Verification

Utilities

Front Office Workflows

At a Glance

In the world of medical billing, perhaps the two most important questions you can answer are:

How much have payers told us we’ve been reimbursed?

How much of that has actually arrived in our bank account?

Getting a clear answer to #1 can be challenging enough, but some practices are forced to spend tremendous amounts of time manually matching up bank deposits with EOBs in order to make sense of what they’ve been paid and find out what payments are missing.

It’s important work, but it’s also a slog.

That’s why Athelas has a Remittances page, with built-in deposit verification.

In this tab you’ll be able to view a list of every remittance a payer has sent you. Once you plug in your bank account via our secure Plaid integration we’ll attempt to automatically match those remittances up with deposits, reducing the burden of deposit verification by as much as 80%.

Read on, and we’ll dig into the details.

Best Practices

1. While Athelas will be able to automatically match the majority of your remits/deposits, some portion will still need to be manually matched. For this reason it’s worth reviewing your unmatched remittances/deposits at least every 2 weeks to keep the volume of unmatched pairs manageable.

2. Often remittances will arrive a few days before payments hit the bank, so for any remittances younger than 5 days old, don’t be too worried if there’s no corresponding deposit in your bank account just yet.

3. When you deposit multiple checks at once, your bank will usually sum them all up into a single deposit which makes it hard to match them against individual remittances. When you’re looking for payments that correspond to orphaned remittances, this is often a good place to start.

We can reconcile paper check bulk deposits and virtual card transactions

🌐 Core Feature Walkthrough

View All Remittances

Even before you connect your bank account, you’ll be able to view a list of all your recent remittances in chronological order (or a different order if you care to re-sort them).

There can be a lot of data in this view, so we’ve provided tools to help you zoom in on precisely what you’re trying to examine:

Download CSV — for some folks, there’s no place like Excel. If you happen to be a spreadsheet jockey, you’ve got the option to download all the data in this tab. That way you can work in your data manipulation tool of choice.

Filter Remittances — we’ve also provided a wide variety of filters to help you narrow down to just the subset of remittances you’re looking for. This is particularly helpful when investigating missing deposits.

Explore Remittance Details — once you’ve found a remittance you want to examine, clicking on it will take you into a detail view for the remittance. Here you can see each Athelas claim that was a component of the remittance.

Quicklink to Athelas Claim — and to close the loop, clicking any of the specific claims listed in the ERA will open up the Athelas Claim Detail view so you can see remittance info in the context of the rest of the claim details.

Connect Your Bank Account

Once you’re ready to start automatically matching remittances and deposits we’ll need to connect to your bank account via the Athelas/Plaid integration. Here’s how to do it:

From the main Remittances tab, click the Connect Bank Accounts button. This will take you to the linked accounts screen.

From the linked accounts screen you can view any currently associated bank accounts, then click ‘Connect a new Bank Account’ to add a new one.

This will launch the Plaid integration screen which will guide you through the process of authenticating with your bank. Once you’re done, read-only access will be delivered to Athelas for analysis.

Once you’ve completed the connection it may take as much as an hour for data to be fully imported and matching to occur. Once an hour has passed, you can move on to analyzing your matches and mismatches.

Note: If you have more than one bank account you’d like to match against remittances, just repeat the process from the top. You can link as many bank accounts as you like.

Refresh or Delete a Bank Account

To refresh or remove an account, simply click ‘Manage Bank Accounts’ on the Remittances page, then click either the Refresh or Delete icon for that account.

Now that your bank account is hooked up and Athelas has had time to run our algorithmic matching protocol, the fun really begins. You now have 5 different ways to segment your data, depending on your objective:

Analyze Matches / Missing Deposits

Now that your bank account is hooked up and Athelas has had time to run our algorithmic matching protocol, the fun really begins. You now have 5 different ways to segment your data, depending on your objective:

View All — in this view you’ll see a combination of both remittances and deposits. Any that have been matched will appear combined into a single line item, but you’ll also see rows for unmatched remittances and unmatched deposits.

Missing ERAs — here you’ll see any deposit for which Athelas couldn’t find a corresponding remittance to match it to.

Missing Payment — on the flip side, this view shows remittances with no payments that could be directly matched to them

Inconsistencies — here Athelas was able to match a remittance to a deposit, but there’s some discrepancy between the two.

Generally this a difference in payment amount (often only a few cents), but each row will specify that the inconsistency in the match is.

Matched Deposits — as you might expect, this view holds all our unproblematic matches where a remittance clearly belongs with a given deposit and the numbers all line up nicely.

In Conclusion

With these tools in hand, the process of tracking down missing payments and missing remittances becomes a lot simpler. As Athelas continues to refine our matching algorithm there will be more and more matches generated automatically.

98%+ ACH deposits matched to a check

💬 FAQs

What should I do if my bank doesn’t integrate with Plaid?

Reach out to support@getathelas.com and we’ll see if we can manage an alternate method of importing your deposit list. Occasionally this isn’t possible, but often we’re able to find a suitable workaround.

Features In Development

Lockbox integrations

Enhanced deposit matching reporting in Insights

Features Not Supported

Local regional banks not on Plaid

Integrations With:

Plaid

Stripe

Last updated:

Aug 20, 2025

Bank Deposit Verification

Utilities

Front Office Workflows

At a Glance

In the world of medical billing, perhaps the two most important questions you can answer are:

How much have payers told us we’ve been reimbursed?

How much of that has actually arrived in our bank account?

Getting a clear answer to #1 can be challenging enough, but some practices are forced to spend tremendous amounts of time manually matching up bank deposits with EOBs in order to make sense of what they’ve been paid and find out what payments are missing.

It’s important work, but it’s also a slog.

That’s why Athelas has a Remittances page, with built-in deposit verification.

In this tab you’ll be able to view a list of every remittance a payer has sent you. Once you plug in your bank account via our secure Plaid integration we’ll attempt to automatically match those remittances up with deposits, reducing the burden of deposit verification by as much as 80%.

Read on, and we’ll dig into the details.

Best Practices

1. While Athelas will be able to automatically match the majority of your remits/deposits, some portion will still need to be manually matched. For this reason it’s worth reviewing your unmatched remittances/deposits at least every 2 weeks to keep the volume of unmatched pairs manageable.

2. Often remittances will arrive a few days before payments hit the bank, so for any remittances younger than 5 days old, don’t be too worried if there’s no corresponding deposit in your bank account just yet.

3. When you deposit multiple checks at once, your bank will usually sum them all up into a single deposit which makes it hard to match them against individual remittances. When you’re looking for payments that correspond to orphaned remittances, this is often a good place to start.

We can reconcile paper check bulk deposits and virtual card transactions

🌐 Core Feature Walkthrough

View All Remittances

Even before you connect your bank account, you’ll be able to view a list of all your recent remittances in chronological order (or a different order if you care to re-sort them).

There can be a lot of data in this view, so we’ve provided tools to help you zoom in on precisely what you’re trying to examine:

Download CSV — for some folks, there’s no place like Excel. If you happen to be a spreadsheet jockey, you’ve got the option to download all the data in this tab. That way you can work in your data manipulation tool of choice.

Filter Remittances — we’ve also provided a wide variety of filters to help you narrow down to just the subset of remittances you’re looking for. This is particularly helpful when investigating missing deposits.

Explore Remittance Details — once you’ve found a remittance you want to examine, clicking on it will take you into a detail view for the remittance. Here you can see each Athelas claim that was a component of the remittance.

Quicklink to Athelas Claim — and to close the loop, clicking any of the specific claims listed in the ERA will open up the Athelas Claim Detail view so you can see remittance info in the context of the rest of the claim details.

Connect Your Bank Account

Once you’re ready to start automatically matching remittances and deposits we’ll need to connect to your bank account via the Athelas/Plaid integration. Here’s how to do it:

From the main Remittances tab, click the Connect Bank Accounts button. This will take you to the linked accounts screen.

From the linked accounts screen you can view any currently associated bank accounts, then click ‘Connect a new Bank Account’ to add a new one.

This will launch the Plaid integration screen which will guide you through the process of authenticating with your bank. Once you’re done, read-only access will be delivered to Athelas for analysis.

Once you’ve completed the connection it may take as much as an hour for data to be fully imported and matching to occur. Once an hour has passed, you can move on to analyzing your matches and mismatches.

Note: If you have more than one bank account you’d like to match against remittances, just repeat the process from the top. You can link as many bank accounts as you like.

Refresh or Delete a Bank Account

To refresh or remove an account, simply click ‘Manage Bank Accounts’ on the Remittances page, then click either the Refresh or Delete icon for that account.

Now that your bank account is hooked up and Athelas has had time to run our algorithmic matching protocol, the fun really begins. You now have 5 different ways to segment your data, depending on your objective:

Analyze Matches / Missing Deposits

Now that your bank account is hooked up and Athelas has had time to run our algorithmic matching protocol, the fun really begins. You now have 5 different ways to segment your data, depending on your objective:

View All — in this view you’ll see a combination of both remittances and deposits. Any that have been matched will appear combined into a single line item, but you’ll also see rows for unmatched remittances and unmatched deposits.

Missing ERAs — here you’ll see any deposit for which Athelas couldn’t find a corresponding remittance to match it to.

Missing Payment — on the flip side, this view shows remittances with no payments that could be directly matched to them

Inconsistencies — here Athelas was able to match a remittance to a deposit, but there’s some discrepancy between the two.

Generally this a difference in payment amount (often only a few cents), but each row will specify that the inconsistency in the match is.

Matched Deposits — as you might expect, this view holds all our unproblematic matches where a remittance clearly belongs with a given deposit and the numbers all line up nicely.

In Conclusion

With these tools in hand, the process of tracking down missing payments and missing remittances becomes a lot simpler. As Athelas continues to refine our matching algorithm there will be more and more matches generated automatically.

98%+ ACH deposits matched to a check

💬 FAQs

What should I do if my bank doesn’t integrate with Plaid?

Reach out to support@getathelas.com and we’ll see if we can manage an alternate method of importing your deposit list. Occasionally this isn’t possible, but often we’re able to find a suitable workaround.

Features In Development

Lockbox integrations

Enhanced deposit matching reporting in Insights

Features Not Supported

Local regional banks not on Plaid

Integrations With:

Plaid

Stripe